Voice of Customer

Project Summary

The agency did not have an ongoing communication strategy with our customers or employees. Feedback collected from customers was not scaled to support enterprise wide actions or strategic decision making.

Results

We were able to deploy over 20 surveys that collected feedback for general web users, specific digital product touchpoints, in-person visits, and phone interactions. During the first year, we onboarded over 300 employees in various roles including executives, regional office staff, office managers, and product team members.

Process

Key Learnings

Product teams were often unsure of their goals once they collected feedback from customers. Our purpose was to provide value by understand their needs, helping them determine the best way to capture feedback, and identify metrics to define success.

Problem Space

Challenge

Build an enterprise Voice of Customer platform that provides a way for product teams to collect and review customer feedback. Make the data repors and visuals easy to understand.

Goals and Objectives

- Deploy a Voice of Customer program for enterprise usage across the agency.

- Start collecting feedback from members of the public to inform agency decision-making.

- Close the loop with customers experiencing issues online or with their attempts to obtain service.

- Ongoing communication with customers and employees about their experience throughout their journey life-cycle.

Process

We collected feedback from customers in various ways including:

Monitoring Feedback

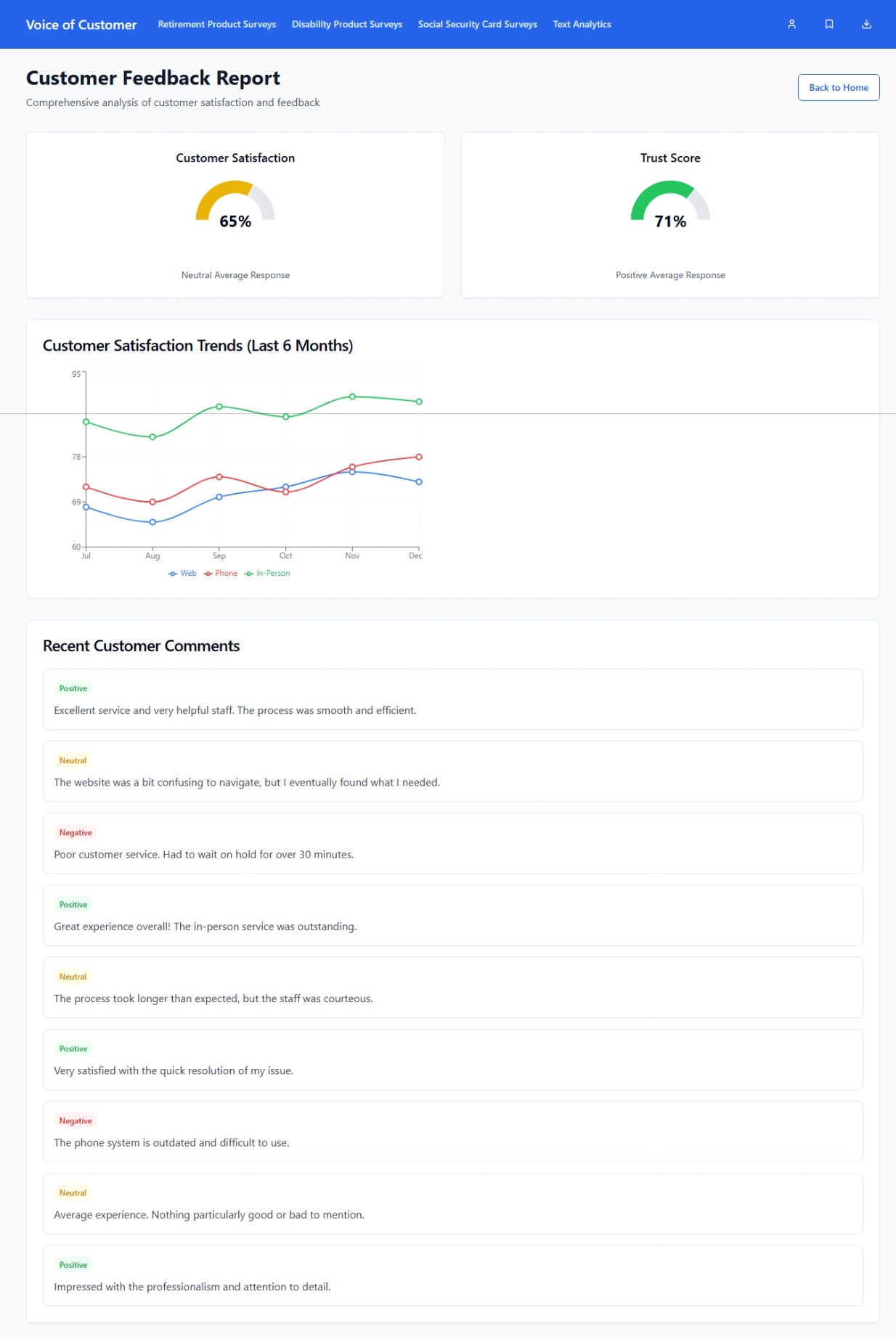

Real Time Reporting

As customers submitted surveys, their responses were added to the live data reports.

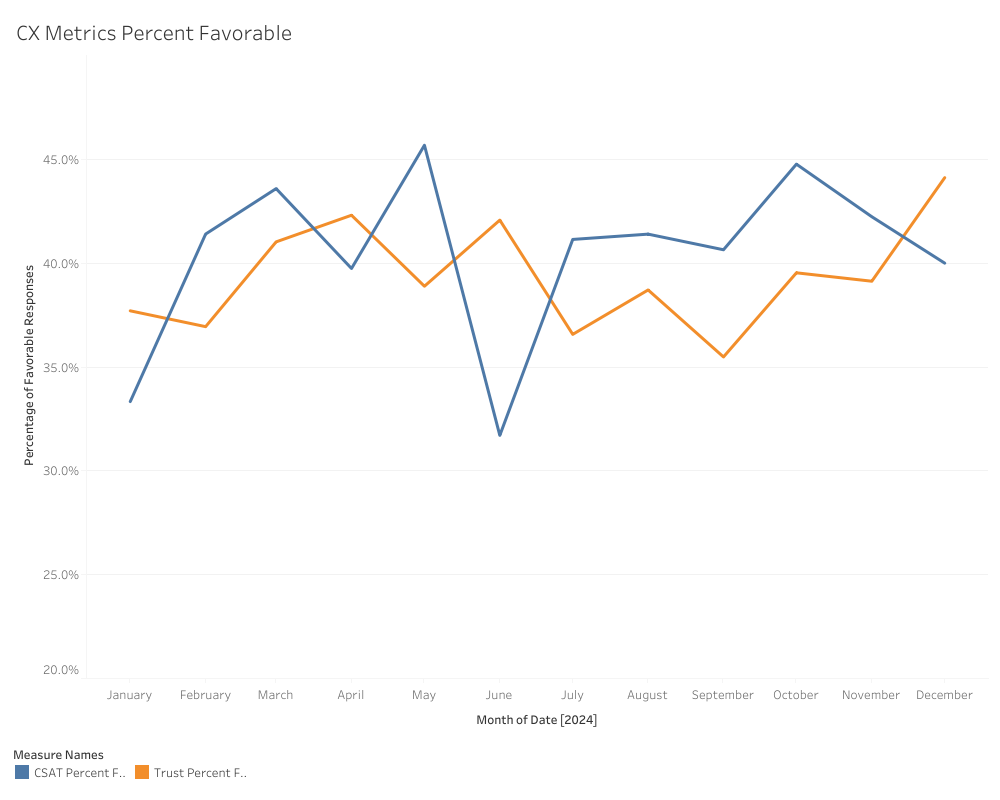

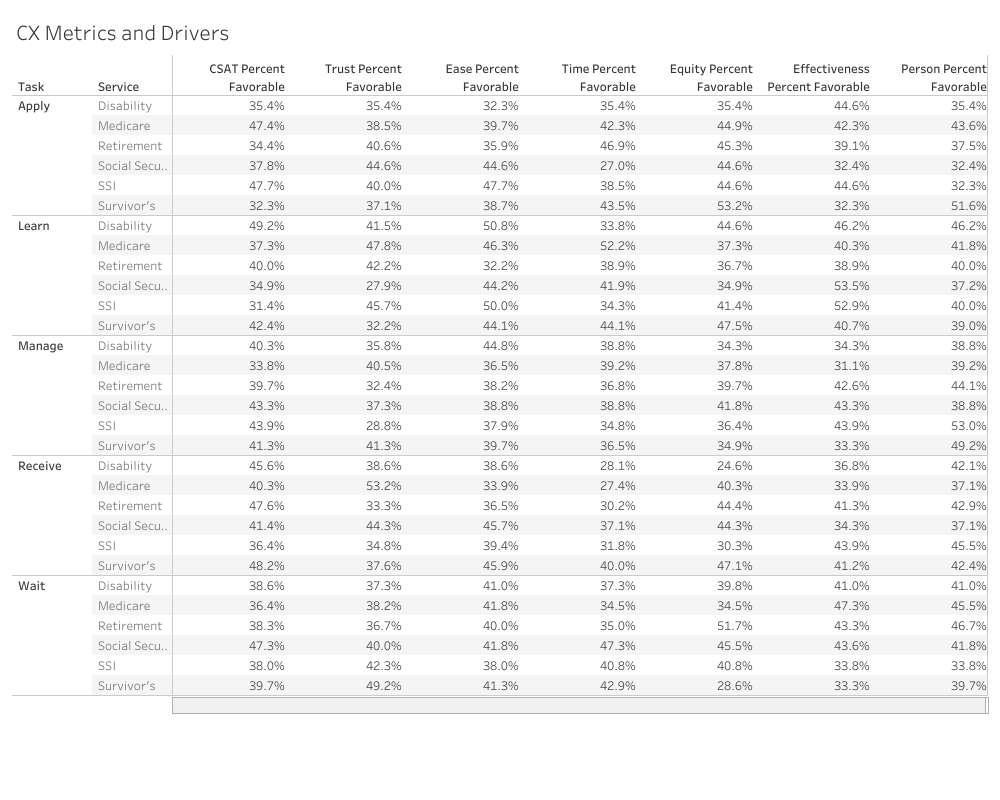

CX Perception Metrics

We monitored primary CX metrics as customer satisfaction (CSAT) and trust. We built reports that allowed us to understand normal service trends over time. Then we could highlight changes after key events like product enhancements, policy changes, or unexpected closures.

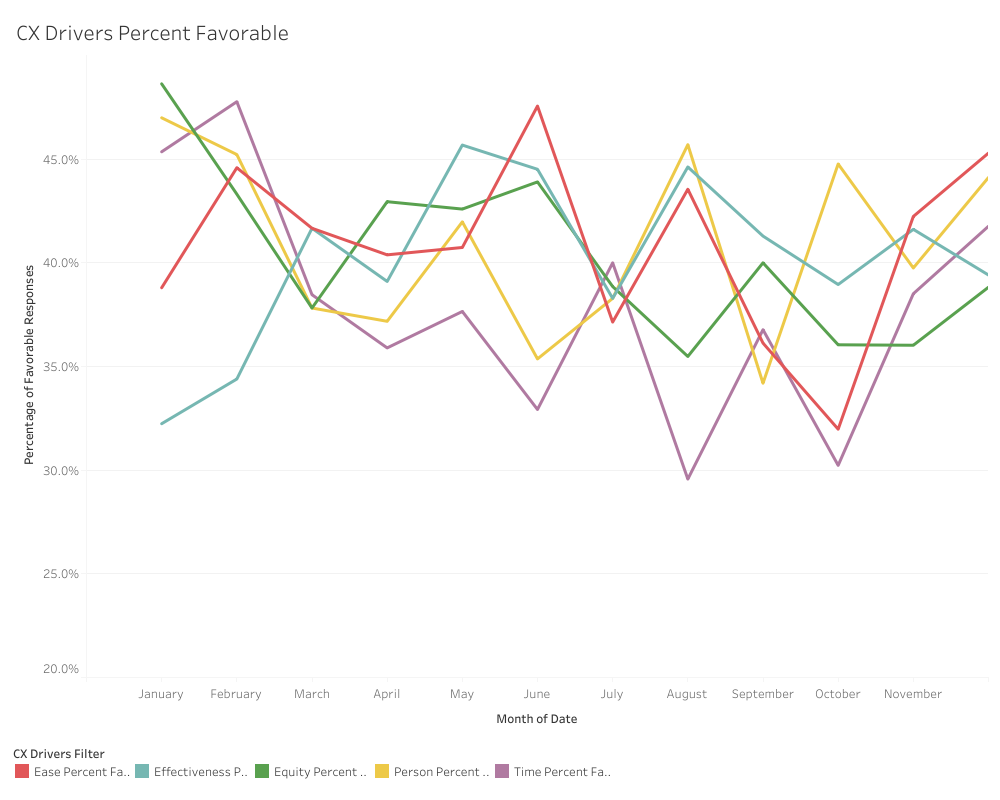

CX Perception Drivers

We used CX drivers to understand the factors affecting CSAT and trust. Ease of doing business made the highest impact to customers describing a satisfactory interaction. Customers that left more neutral responses often were happy with the service representative but unhappy with the difficulty and complexity of completing their business.

Perception and Interaction Data

We paired this customer perception data with business interaction data to understand the full scope and severity of opportunity areas.

Conclusion

Understanding the customer’s experience across different journeys and service areas allowed us to map experiences, blueprint interactions, and scope problems to find meaningful solutions. We hosted bi-weekly open office hours to allow product team members, executives, and regional staff to come and ask questions or learn from others' questions.